How dentists can select the ideal disability policy, and why they need it

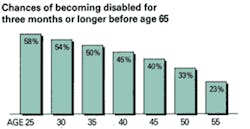

Financial planners say that protecting your income is the cornerstone of financial planning. According to statistics, you have a 45% (at age 40) chance of becoming disabled for a substantial period of time during your lifetime. Wouldn’t you agree that protecting your income and your ability to work is your most valuable asset? Protecting your lifetime earnings, which could be over several million dollars (from age 45 at $150K to $300K per year to age 65), should be high on your list. This article will help you sift through the wording maze of different contracts (policies) offered and, if coverage is applied for, will correct the problem of being without adequate protection.

READ: DISABILITY INSURANCE URGED FOR DENTAL HYGIENISTS

What to look for in an ideal disability insurance policy

If every company offering a disability insurance policy (contract) were to offer the same wording, terms, and conditions, then your job as a professional would be easy — all you would have to think about would be something simple, such as whether or not you liked the company’s logo. Unfortunately, evaluating and selecting the right contract is not so easy. There could be as many as 30 or more wording considerations, all of which make up a contract and each affecting policy benefits — how much, how long, and under what conditions and circumstances a claim will be paid.

However, in view of what might otherwise be a formidable task, most companies offer enough similarities in most of the 30 or so components, with the differences not as important as the following nine, which will be discussed in detail. I have listed these major differences in the same order as they appear in most contracts:

Summary of differences

- Renewability (under what conditions your policy will be renewed)

- Definition of Sickness (when illness first appears [manifests] vs. when you got the disease [contracted])

- Definition of Total Disability (will you be able to work in another occupation and still be paid?)

- Definition of Benefit Period (how long you will be paid)

- Residual/ Proportionate Disability Benefit (will you be paid while still working in your occupation, but suffer a loss of income and while under adoctor’s care)

- Recovery/Extended/ Transition Benefit (same as above, but with full recovery and still suffer a loss of income)

- Future Increase Option Benefit (will you be able to get an additional benefit amount, even if you are now uninsurable?)

- Cost of Living Adjustment (COLA) Benefit (helps to replace what inflation has eroded from the benefit’s buying power)

- Miscellaneous

Renewability

One of the most dramatic changes the industry has made in the last couple of years is the introduction of Guaranteed Renewable (GR) Only policies. This change allows carriers to raise rates if claims and other negative factors increase, and thus remain profitable. However, get yourself a GR/Non-Can policy. The non-can feature allows the insured to have a policy that guarantees rates up to age 65, as well as guarantees renewability to 65. Thereafter, renewability will be conditional.

Definition of sickness

Wording should say, “When it first manifests” rather than “when first contracted.” The difference is significant, especially if the disability, for example, is caused by cancer. Under the first definition, even if cancer existed when the policy was issued but had not yet appeared, nor caused a prudent person to seek medical attention — it would be covered. Under the second definition it would not be covered, if it could be proven to have existed prior to the effective date of the policy.

Definition of total disability

This is the guts of the policy and sets the guidelines as to whether or not you will be considered disabled, and as a result, paid. The policy should have an Own-Occupation definition for total disability. There are three different Own-Occ definitions and one other type that is offered by the industry. These are based on occupations, which for the most part reflect the claims experience of a particular carrier. These definitions are listed with the most liberal first.

a) Own Occupation — This allows the insured to be paid the monthly benefit amount even if working elsewhere, so long as it is another occupation. Some carriers offer an own-occ specialty definition. This definition might be necessary for someone that has a skill that could be transferred to another, e.g., a surgeon who only does root canals. Without this definition, the person could be expected to teach, or became involved in some related discipline within the medical field, and as a result, might not be considered Totally Disabled.

b) Own Occupation-Not working elsewhere — This definition allows the insured to be paid if the person can’t do the duties of his or her occupation and is not gainfully employed elsewhere. Working or not, then becomes the choice of the claimant.

c) Own Occupation-Unable to work elsewhere — This definition will allow the insured to be paid only if the person can’t do the material duties of his or her occupation and is unable to work elsewhere. This definition gives the carrier more control of the claim.

d) There can also be a variation of b) and c) whereby it becomes a split definition, which gives definition a) a period of a few years, usually five, then changes to either b) or c). This is the least desirable to the insured and protects the company from those who wish to malinger. If one does return to work and there was a loss of income and the person had a residual benefit, the person would be paid under the loss of earnings described below.

e) Loss of Earnings — This has been around for a long time, but recently many more carriers have chosen to stipulate this definition in lieu of the Own-Occ. A loss of earnings policy is really a policy that doesn’t have a total disability benefit, only a residual (proportionate) benefit. For example, if during a disability there is a 30% loss of income, it pays 30% of the monthly benefit proportionately. While it does pay proportionately, it is important to note that the insured also starts off with a 40% shortfall due to the carrier’s participation tables only covering approximately 60% of income. (Benefits are usually paid on a tax-free basis if the insured pays the premium.)

Definition of benefit period

This represents how long someone will be paid in the event of a covered disability. Most if not all carriers have benefit periods that range from two years to age 67. Some carriers offer a graded lifetime benefit, which simply states that you will get a reduced percentage of the benefit amount paid during you lifetime depending on the onset age.

Elimination period

This is the number of days for which no payment will be made (just like any other deductable) and the key provision in a policy is that the days of disability need NOT be consecutive, meaning the disability can be a “stop and go.” Some policies read that if there’s a break, the countdown begins again.

Residual/proportionate disability benefit(same as loss of earnings)

Most contracts read about the same for this benefit, except for some of the following terms and conditions. These can make a difference in terms of how much of a claim will be paid.

a) Predisability earnings period — Typical contracts state that they will consider the previous 12 months or any two consecutive years within the last five, whichever is most favorable to the insured, to establish a baseline in order to measure the loss of earnings. There are also some other combinations.

b) Pre-disability income included or excluded for the loss/earnings calculation — This can be a significant factor if the claimant is, for example, in the service industry (CPA, attorney, etc.) and has some accounts receivable (predisability earnings) paid during a period of disability. If the contract does not allow these to be excluded, then the calculation will generate a lower loss of income, and as a result the payment will be smaller. Conversely, if these are excluded, the loss of earnings percentage will be higher and a larger benefit will be paid.

c) Qualification period — This are the number of days that the insured must be totally disabled before the residual benefits can start. Companies who have this type of restrictive period usually limit it to 30 days. Most companies do not impose this qualification period at all and allow periods of residual disability to count toward the elimination periods as well.

d) Benefit trigger should be no more than 20%, and some companies use 15% as well as other caveats.

Recovery/extended/transition benefit

This benefit allows a person who is no longer under a doctor’s care to be paid as if the person were still disabled (even though he or she has returned to work full-time) so long as there is at least a 20% loss of income. This allows dentists (after watching their practice and their network disintegrate while disabled) return to work and still be paid while their practice is being rebuilt. Benefits under this provision would continue to be paid even though the dentist is fully recovered, until income reaches 80% of predisability earnings. Again, some companies offer this benefit but for different periods of time, e.g., 12 or 24 months, and some for the full benefit period (age 65).

Future increase option benefit

This benefit allows someone who is underinsured to apply for additional coverage, even though they have health problems and are normally otherwise uninsurable. Most companies offer this option, however, once again there are contractual differences to watch out for:

a) Cut-off age for having this option issued as part of the coverage in the contract. Typically, the age whereby one can no longer apply or it is no longer offered is age 50, although there are a few companies that will still issue it up to age 55.

b) I haven’t seen any company allow it to be exercised past 55. Most, if not all, use a formula as to how much can be exercised at any given time based on age and other factors, participation tables not withstanding.

Cost of living adjustment (COLA) benefit

This allows the monthly benefit to be increased so that it keeps up with what inflation has eroded from the benefit’s potential buying power. Some COLA differences that exist between companies fall into two categories:

a) Basis for increase, for example, CPI vs. guarantees, and simple vs. compound.

b) Purchase conversion of these benefits when claimant returns to work, prior to what age and what cost, if any. This is especially important if there is a relapse of the original claim or there is a new claim and one wants the new claim to begin with the last benefit amount paid, rather than starting over again with the original benefit amount issued.

Miscellaneous

Other related contract components that should be considered when one is analyzing a contract are:

a) Conditionally renewable after age 65 — Most are renewable to 75 (after age 65), while others offer renewability for a lifetime (only if gainfully employed, and minimum is 30 hours a week).

b) Loss of income percentage necessary to be deemed totally disabled (i.e., most say 75% while a few use 80%). Obviously, the lower the percentage the better the contract.

c) Recurrent disability — Some say six months and others say 12 months. Which one is better depends on whether or not there is a short benefit period of say, five years. If for a particular claim the benefit period has expired, then I suggest six months if there is a relapse, then the benefit period begins again. On the other hand, if the benefit period has not yet expired and the claimant returns to work and suffers a relapse after six months, then a 12-month period is better because in this case the elimination period does not have to be satisfied again.

--------------------------------------------------------------------

RELATED ARTICLES:

The case for disability insurance

Product Enhancements in Disability Insurance

--------------------------------------------------------------------

Disability Insurance Resource Center is the nation’s largest agency exclusively specializing in disability insurance (including hard to place cases due to health or other issues). Its founder, Lawrence Schneider, Disability Income Insurance Specialist, has over 35 years of experience devoted to this product, has written close to 50 articles for many major publications, and is in demand as a guest speaker and consultant. He is also an expert witness for claimants who have been wrongly denied benefits. He can be reached at 800-551-6211, through his website at www.di-resource-center.com, or his email at [email protected].