Readers surveyed on dental staff pay strategies

Reprinted with permission from The McGill Advisory

In response to the sluggish dental economy, the number of practices giving annual pay raises in 2013 continued to shrink. Fortunately, more doctors have implemented our recommended collections-based bonus plan to reward staff. Below, we discuss the recent reader survey results, and the recommended pay strategies for staff for 2014.

One year ago, we noted that due to the tight economy and increased managed care penetration, less than 50% of dental practices gave annual pay raises in 2012. Moreover, we predicted that percentage would drop to as low as 40% in 2013 due to the continuing economic uncertainty, health-care reform costs, and higher supply, lab, and equipment costs.

Some final thoughts about the fairness of pay raises awarded to dental hygienists

We were shocked by our recent reader survey results, with over 400 doctors responding from our family of over 7,500 top-tiered dental practices across the country. The survey revealed that only 28% of practices actually gave across the board pay raises to staff during 2013, while 72% did not.

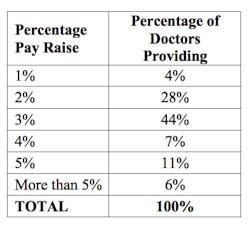

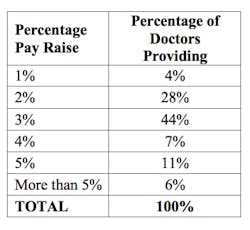

Of those practices giving pay raises, the average percentage pay increase was as shown below:

National pay raise trends

The highest percentage (44%) of doctors gave 3% average pay raises in 2013, the same as the national salary increase average for 2013, and that planned for 2014. After factoring in annual Consumer Price Index growth of 1.4%, the average pay increase would result in a net gain of 1.6% for staffers.

Pay raises were not granted equally to all employees nationally, but rather based upon performance ratings. Employees with the highest performance ratings were granted an increase of 4.6%, those with an average rating got a 2.6% raise, and staffers with below average performance ratings received only a 1.3% boost.

With the job market remaining relatively soft, most companies aren’t feeling pressured to raise salaries by much more than the rate of inflation. Moreover, the rising cost of health care has also limited pay increases. In order to retain key employees, however, employers are making bonuses a larger part of the total pay package to reward employees on a cost-effective basis.

Effective staff bonus plan

We were very pleased that over 33% of responding doctors have adopted our recommended strategy of freezing staff salaries and implementing a bonus plan based on increased collections. Our recommended bonus system is simple but effective – paying out more to employees if, and only if, practice collections grow. Specifically, we recommend that doctors pay out a bonus in July of 2014, based upon the increase in collections for the first six months of the New Year, compared to the same time period for 2013. We recommend repeating the process in December of 2014, using the same approach.

Find and hire the right person for your dental practice or it could cost you thousands

The percentage of collections increased to be paid out as a bonus should be based on the industry average salary percentage for each segment of dentistry as follows — general dentistry – 25%, pediatric dentistry – 22%, periodontics – 21%, orthodontics – 20%, oral surgery – 18%, and endodontics – 16%.

Individualized bonuses

Once the total dollar amount of the bonuses has been calculated for the entire staff, do not make equal distributions to each staff member, since that rewards mediocre and poorly performing employees while penalizing the above average performers. Rather, the bonuses should be distributed on an unequal basis, based upon each staff member’s relative contribution to the practice’s success. Doctors should establish individual performance goals for each employee, and tie their share of the bonus to their success in reaching those goals.

Tax-optimized pay outs

Next we recommend asking staff members in what form they would like to receive their bonus, in order to provide the highest perceived value to each employee. Some may elect to defer all or a portion into their 401(k) plan account on a tax-deductible basis, while others may elect to have all or part paid out as a tax-free contribution to their health savings account (HSA) if they qualify for one, where it can grow and compound tax-free to meet future medical costs.

Others may choose to have it paid out in the form of medical reimbursement, childcare reimbursement, uniform allowance, or other tax-free fringe benefits. These arrangements also benefit the practice since there are no matching payroll taxes, nor retirement plan contributions due on the value of these tax-free fringe benefits.

Employee communications

In order to provide the proper incentive, it’s critical that the bonus plan details, and reasons behind it, are communicated to the staff up front. Furthermore, make sure to also communicate the total compensation paid to each employee during 2013, using a Total Pay Statement. This comprehensive statement, to be delivered to the employee along with their W-2, educates them about the total benefits they are currently receiving, calculated on a total compensation-per-hour basis for easy comparison.

This article was reprinted with permission from The McGill Advisory, a monthly newsletter with online resources devoted to tax, financial planning, investments, and practice management matters exclusively for the dental profession, published by John K. McGill & Company, Inc. Visit mcgillhillgroup.com, or call the newsletter department at 888-249-7537 for further information.