‘Good debt:’ The power of combining leverage and retirement savings for dentists

Are you considering an addition or improvement to your practice? You may have the available cash to build, but I suggest you look into financing during this low interest rate environment, especially if you can use the extra cash flow from financing to make or increase annual tax deductible retirement plan contributions.

1) “Good debt” is using long-term financing in order to free up current cash flow, which allows you the flexibility to deploy the cash into retirement investment opportunities with greater return potential.

2) The interest cost of debt is lower than the actual interest rate because you’re getting a tax deduction. For example, if your interest cost is 5% annually and you are in a 33% tax bracket, then the real cost of debt is 3.35% (5% * 67%).

3) More free cash flow allows you the flexibility to save more for retirement while reducing your taxes, and it gives you the opportunity to seek investment returns greater than the cost of debt at 3.35%.

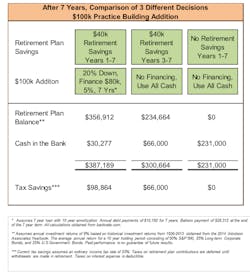

Let's assume you have $100,000 cash in the bank. You’ve saved it over three years with approximately $33,000 annually in extra cash flow. You’re adding on to your dental office to meet increased patient demand, and also give you space to accommodate an associate dentist if you decide to hire one. The cost of the addition is $100,000. You can use the $100,000 to pay for the addition outright because this seems very logical and easy. But, is there a better strategy?

Using “good debt,” you could pay 20% down ($20,000) and finance $80,000 at 5% over seven years on a 10-year amortization schedule. Your annual debt payments (principal and interest) would be $10,182. You would also begin saving $40,000 annually to a company retirement plan, which reduces your taxes each year by $13,200 assuming you are in the 33% marginal tax bracket. Assuming an 8% annual investment return on your retirement plan account, your balance at the end of seven years would be $356,912.

ALSO BY TRIPP YATES:Tax diversification – minimize your taxes in retirement from your dental practice

Cash balance pension plans for dentists — maximize your current tax savings

As you can see in the three decisions here, using good debt reduces your current taxes the most while allowing you to maximize retirement savings. If you pay cash and wait until year three to start retirement savings, you’re giving up approximately $33,000 in current tax savings. Also, the longer you wait to start saving the less likely you are to make the decision to begin. Lastly, paying cash for the addition and not using retirement savings builds up your bank account but minimizes your retirement plan balance and tax savings.

Michelle Couch, senior vice president at Patriot Bank in Millington, Tennessee, said, “When anticipating rising interest rates, locking in low fixed rate loan terms early will be beneficial for borrowing needs.” Patience and discipline are key attributes needed for using leverage while fulfilling retirement savings. In a low interest rate environment, “good debt” can be used as a strategy to begin or increase retirement plan contributions and lower current taxes.

This article first appeared in DE's Expert Tips & Tricks. To receive enlightening and helpful practice management articles in this e-newsletter twice a month, visit dentistryiq.com/subscribe.

Tripp Yates is a Wealth Strategist for Memphis-based Registered Investment Advisor Waddell & Associates. He is a CPA and CFP®. He believes that executing ongoing financial planning strategies can have a major long-term impact beyond investment returns. He can be reached at [email protected]. Visit Tripp’s blog at strategiesmatter.com.

Disclaimer

Waddell & Associates is an SEC-registered investment adviser. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.