Wise-up Wednesday from Zane Benefits: How much will individual health insurance reimbursement cost your dental practice?

Researching health benefits for dental practices often starts with group health insurance quotes, reviewing different carriers, coverage levels, and costs. But if you’re in sticker shock or a group policy simply is not a good fit, what are your options? Here’s a savvy approach many smaller dental practices are taking—don’t offer group health insurance coverage. Rather, offer a formal benefit program to reimburse employees for individual health insurance policies.

This approach is a viable solution for small dental practices because employees gain access to quality and customized health insurance coverage. The company controls costs by setting a monthly contribution amount toward qualified premiums. Average employers could fully fund an individual family policy for less than they could fund a portion of that family's coverage under a group policy.

But I may be getting ahead of myself. First I’ll walk through the average cost of individual health insurance, then I’ll cover how to offer a compliant employer reimbursement (“contribution”), and lastly I’ll boil down the cost to your dental practice.

Note: This blog post is based off our new infographic, 7 Truths About The Cost of Health Insurance In America. Check out the full infographic here.

Individual health insurance costs 43% less

To understand why a reimbursement approach works so well, consider this: on average, individual health insurance policies cost less than a small group health insurance policy. Let’s look at the national data. For single coverage, an individual policy costs $3,587 a year on average, a 43% savings compared to average group coverage at $6,251 a year. Factor in the tax subsidies available for individual coverage and the savings increase up to 60% annually.

For family coverage, an individual policy costs $10,739 a year on average, a 39% savings compared to average group coverage at $17,545 a year. If eligible for tax subsidies, savings for individual family coverage average 68%.

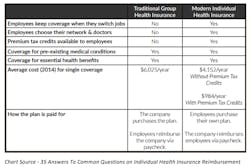

Unfamiliar with how group health insurance and individual health insurance stack up? Here’s a helpful chart:

How to reimburse employees for individual health insurance

You may have heard you can no longer reimburse employees or pay for employees’ individual health insurance policies. In some cases, this is true. As part of health care reform, there are new penalties for non-compliant reimbursement or payment plans. However, there are also two compliant ways to help employees with the costs of individual health insurance.

The first is for the company to set up a tax-advantaged Section 105 reimbursement plan to give employees a health-care allowance to use on health insurance premiums. Think of it like a business expense account or gift card for health insurance.

Here is how it works:

• Step 1—Dental practice establishes a formal reimbursement plan, setting eligibility criteria and monthly health care allowances.

• Step 2—Employees purchase their own health plan, with their own money.

• Step 3—Employees submit a reimbursement request, usually to a third-party or online software platform.

• Step 4—The reimbursement requests are reviewed and substantiated (again, by a third-party platform) and the practice reimburses the employees for approved expenses via payroll, check, or direct deposit.

The second way is to offer employees taxable raises or stipends to cover health insurance. Because of the tax advantages associated with a formal reimbursement plan, most dental practices and employees prefer this route.

The cost to your dental practice

The beauty of individual health insurance reimbursement is that the contribution amount is completely set and controlled by the employer. Individual health insurance costs about 40% less than comparable group health insurance premiums, so the practice’s health-care dollars are stretched farther. Unlike traditional group coverage, there are no minimum contribution amounts.

Exact rates will vary by location and employee demographics. Here is an example of typical cost savings (based off 2014 health insurance costs for the state of Illinois). In this example, a 45-person company saved $275,058 annually (61%) with individual health insurance reimbursement.

Conclusion

Health benefits are a vital component of compensation offered to employees. Yet with escalating costs, meeting the expectations of employees is increasingly difficult. One solution well suited for small dental practices is to implement an individual health insurance reimbursement program. The cost? Whatever the company allocates. Bottom line? The average practice could fully fund an individual family policy for less than it could fund a portion of that family’s coverage under a group policy.

To learn more about individual health insurance reimbursement, download the free guide “35 Answers To Common Questions on Individual Health Insurance Reimbursement.” Wise-up Wednesday is presented bi-monthly from the experts at Zane Benefits. One Wednesday a month features Human Resource issues, and the other Wednesday discusses health benefits.

RECENT WISE-UP WEDNESDAYS:

Will retirement of baby boomers shrink the dental industry?

Health benefit options for dental practices in 2016

3 key HR management strategies for dental practices in 2016