Understanding dentists' decision making with the magic of Venn

This is the second installment of a two-part series from Rachel Mele of Vennli. Click here for part one.

Remember when we learned about Venn diagrams in middle school? I still remember trying to find classmates who had things in common with me to put in the overlapping section.

Those three circles conveyed a lot of information in an intuitive, visual way. We have these things in common; we have these things that are unique.

I previously talked about the importance of understanding how dentists make decisions when adding new technology or equipment to their practices. It all comes down to winning the dentists’ choice. Dentists make decisions that impact your success. You need to understand what factors impact those choices before you can strategize to influence them.

The best way to do this is–surprise—to ask them. Obtaining insights directly from dentists about their decision making allows you to visualize your opportunities from their viewpoint (which is arguably the most important). Their perceptions (which drive their behavior) determine whether or not your strategy will be successful.

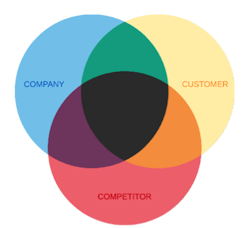

Ultimately, it comes down to nine simple words: Be different from competitors in ways important to your dentists. Sounds simple, but it can be complex in application. The best way to develop a strategy to accomplish this is by viewing the dental market in one of those beloved Venn diagrams.

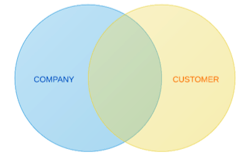

The yellow circle is your customer (in this case, dentists). The overlap between what dentists value (yellow circle) and what you provide (blue circle) represents the value you provide to dentists.

This is important information, but, let’s be brutally honest: We exist in a constant state of competition. It doesn’t matter what value we provide—it matters what we provide that our competitors do not. Therefore, it’s crucial to ask dentists how they perceive our value and the value of our competitors (red circle) so that our strategies build our competitive advantage.

Armed with this competitive information, you may realize that much of the value you provide is matched by your competition. In other words, the value you provide is not actually a competitive advantage. Ouch. You may also find that your competitor is providing value that you do not.

This can be a wakeup call, creating a sense of urgency to develop strategies to improve your competitive position.

Let’s look at a simple example. Here’s a dental equipment company that wants to increase sales to its current customers, dentists. It has a direct competitor with a similar offering. The company does some customer research and obtains the following results. Each of the colored zones provides important information about how these dentists make decisions, and therefore important strategic implications.

- Green zone: This is what it’s all about! This is your competitive advantage! Your strategy should be centered on building and defending factors in this zone. “Knowledgeable sales reps” falls in this area. How can you continue to build upon this strength? How can we move other factors into the green zone?

- Yellow zone: This represents your dentists’ unmet needs. These could be opportunities to correct dentists’ dissatisfactions or innovate new solutions around unmet needs. “Onsite training” falls into this area—it’s important to decisions but not currently being met by either option. Is this something you can provide to differentiate your offering?

- Purple zone: This area represents what you AND your competition are both offering but customers do not value as much. These two factors could potentially be areas you where you could decrease your focus. Interestingly, “low price” falls in this zone. Often, we think that customers make decisions solely on price, but this shows that there are many other factors more important than price when choosing between offerings. A price-cutting strategy is unlikely to bear fruit in the long-term.

- Red zone: This area represents your competitor’s points of low value. As you determine the best strategy for growth for your business, this section might be an area where you potentially leverage and exploit value that your competitor thinks is important but isn’t. For example, your competitor is perceived as more likely to “offer discounts” here, but let them do so: It’s not important to customer decision-making and will only harm them in the long run!

- Gray zone: This zone represents points of parity between you and the competition (i.e., important factors that you both deliver). You’ll want to differentiate yourself or, at a minimum, at least maintain the attributes customers have come to expect. Here, dentists perceive both of you as having the latest technology. If you actually have features or benefits above and beyond what the competitor offers, it’s in your best interest to improve your marketing to raise awareness, thereby moving this factor into the green zone!

- Orange zone: This displays your competitor’s competitive advantage. Knowing this information would give you the tools to know exactly how to neutralize this area by attempting to change customer perceptions regarding the value of these factors. In this example, dentists perceive your competitor as having better technical support. What can you do to either increase the awareness of your own tech support or decrease the perception of the value of the tech support they offer.

Now you have the key insights necessary to build a strategy. The next step is for your team to determine which factors are the easiest to impact and have the greatest potential for return, building these into your strategy to grow sales of your products. This method keeps your team focused on initiatives that will drive value for dentists.

When you understand how dentists make decisions, you can develop strategies to influence their decision-making so that more dentists choose you.

The true test of whether or not you have really changed a dentist’s perception is time and results.

Growth strategy is a process, not an event. Today’s competitive market requires an agile organization that is constantly innovating, capitalizing on new opportunities, and evolving with their customers. High-performing organizations continuously assess their performance and changes in their market.

When you win more competitive advantage, you have to continually work to keep it. You must be relentless in your pursuit of growth. This requires ongoing measurement of the impact of your strategies—how your competitive market is changing and how your efforts are resonating with dentists. Ongoing customer conversation allows you to capitalize on opportunities quickly (before your competition)and make real-time adaptations to your strategy to achieve your vision.

In today’s market, whoever wins the dentists’ choice, wins. By learning what impacts your dentists’ decision making and their perceptions of you and your competition, you obtain actionable intelligence to build a formidable advantage.

This is what we do and why I get up in the morning. I’m competitive by nature, and with these type of insights, the winning path is clear!

KEEP READING |Three quick ways to get started with content marketing

Rachel Mele is a dental executive, author and international speaker. She runs the dental division at Vennli, a cloud platform for creating and executing growth strategy by understanding customer choice. Rachel grew up in the dental business and has been a dental executive for the last twelve years. Prior to Vennli, Rachel served in sales and business development at Sesame Communications. Rachel was part of the team that led to Sesame’s growth and subsequent acquisition by Internet Brands (owned by KKR & Co.) Rachel started her professional career in the role of practice management consultant to dental practices across the United States, Australia and New Zealand. Rachel has lectured at the GNYDM, ADA, CDA, Yankee, Star of the North and many others. Rachel can be reached at [email protected] or via her website www.rachelmele.com.