Calculating The Return on Investment

Calculating The Return on Investment

By Jack J. Phillips, PhD

Dr. Phillips began the "Booth Camp" column earlier in the year and has covered how to get the most out of your exhibit by focusing on your outcome measures: reaction, takeaways, visitor actions, business impact, and finally, ROI. For more of this series, go to digital.proofs.com.

The previous columns have focused on a variety of outcome measures such as reaction to the exhibit (level 1); takeaways from the exhibit (level 2); booth visitor actions (level 3); and business impact, such as new accounts (level 4). This column focuses on the return on investment (level 5).

The return on investment (ROI) is the ultimate measure of success. Most top executives want to know the actual monetary value they can achieve, primarily from profit increases, which can be derived from the exhibit. When the achievable monetary value is compared to the costs, the financial ROI is developed.

The first step is to convert the data to monetary value. In sales, this is the profit margin. When there is a sales improvement, the profit of the sale becomes the added value (monetary benefits). If the exhibit drives new accounts, the value will be based on the lifetime value of a new account. If both the sales increase for existing customers and new accounts are driven, it is important to avoid double-counting the profits. Customer satisfaction is usually left as an intangible.

Now let's consider another important issue, the stream of benefits. For example, if we captured the weekly sales that were generated in two months, others will generate later. We need a rule to determine how many months we will count. In effect, we would want to count no more than one year of sales — one year from the time the business impact has occurred. Although there is some lasting value in the exhibit (e.g., someone may purchase two years later because of the exhibit), we must be conservative and assume that no sales are connected after the first year. This is important because any process that calculates ROI needs standards (rules). Our rules are the guiding principles and the one year of value is one of them.

It could be appropriate to stop the evaluation at this point, evaluating the exhibit's effect on sales converted to profit. For some executives, it is helpful to convert to the profit margin because that shows the actual monetary value added because of the exhibit. However, in today's economy, executives want to know how this compares to the cost of the exhibit.

This leads to the ROI.

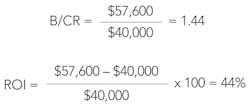

Measuring the ROI is quite straightforward. It is the monetary benefits from the impact measure (i.e., sales for one year) compared to the fully loaded cost of the exhibit. The formula becomes:

In the ADA example, a follow-up at six months reveals that 20 software purchases have been consummated. When considering the other factors — including special promotion, advertising, and market growth — the sales team allocated 30% of the purchases to the exhibit with 80% confidence. With each sale representing $20,000, the 20 sales represent a total of $400,000. Thirty percent of purchases going to the exhibit and 80% confidence yield the multiplication of these three items:

This represents monetary benefits after six months; some sales would come later. An annualized value is needed — this number is doubled for the entire year. This is considered conservative because some sales may occur even past the one-year period, as the products have an unusually long sales cycle, or some situations or events are precluding potential buyers from purchasing at the present time. If this issue of doubling the amount of sales from six months becomes a problem, it is advisable to wait and do the math at the end of the one-year period. However, it is often necessary to collect this data as soon as possible so that the isolation can be conducted properly. Data from the one-year period is used, so this $96,000 becomes $192,000. At a 30% profit margin, the value added becomes $57,600. When considering cost for the exhibit of $40,000, then the benefit/cost ratio becomes 1.44 and the ROI is 44% as follows:

The team had set an original goal of 20% ROI as the acceptable number, which is slightly above what the company expects from capital expenditures. An ROI of 44% is impressive, and is from a conservative analysis. For most studies, some measures are not converted to monetary value. Exhibits create many intangible benefits such as reputation, image, and brand. The intangibles are important and are sometimes more important than ROI and impact data.

This is the rate of investment — the Holy Grail for many executives. This process is credible because the assumptions used in the analysis are based on guiding principles described in other documents.

This is the last column on measuring the success of an exhibit. If more information is needed, please contact the ROI Institute at [email protected] or read Return on Investment in Meetings and Events: Tools and Techniques to Measure the Success of all Types of Meeting and Events, by Jack Phillips, M. Theresa Breining, and Patricia Pulliam Phillips.

Jack J. Phillips, PhD, is a world-renowned expert on accountability, measurement, and evaluation. Phillips provides consulting services for Fortune 500 companies and major global organizations. The author and editor of more than 50 books, he conducts workshops and presents at conferences throughout the world. His expertise in measurement and evaluation is based on more than 27 years of corporate experience in the aerospace, textile, metals, construction metals, and banking industries. He is chairman of the ROI Institute, Inc., and can be reached at 205.678.8181 or by email at [email protected].