COVID-19 has been especially disruptive for high-contact industries, including the $139 billion dental industry. While many projections have been made, it has been challenging to analyze it in detail and quantify the pandemic’s true economic impact.

SoftwarePundit, a technology research firm that advises dental practices on software, and Dental Intelligence, a leading dental practice analytics provider that serves more than 8,000 dental practices in the United States, partnered on a study to try to understand the economic impact of the pandemic on dental practices.

Here are key highlights from their research:

- Collected revenue in dental practices declined 6% year-over-year in 2020

- This was much less than the 38% decline the American Dental Association predicted last June

- Dental hygiene appointments declined by 47% year-over-year in spring 2020 before recovering in the summer and dipping again in the fall.

- The top 10% of practices performed better in 2020 than in 2019 in terms of revenue, average patient value, and patient growth.

Dental practice revenue dropped 6% year-over-year in 2020

Actual performance data from the Dental Intelligence customer base was analyzed to calculate the change in average dental practice revenue from 2019 to 2020. The average Dental Intelligence customer saw a 6% decline in collected revenue in 2020. This was significantly lower than the ADA’s June 2020 prediction of a 38% decline in practice revenue.

Average production for practices was down 3.1% in 2020 compared to 2019. This means that, on average, practices collected a lower percentage of their produced revenue in 2020 compared to 2019.

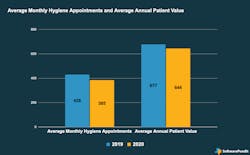

In 2020, practices saw a 5% decline in average annual patient value from $677 to $644. While this is not a great outcome, it does mean that the bulk of change in collected revenue between 2019 and 2020 was due to a decline in average patient value rather than a loss of patients (figure 1).

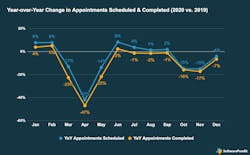

Dental practice revenue declined by an average of 6% for the full year in 2020. However, there was significant variance from month-to-month. The beginning of 2020 started well, with practices seeing a 4%–5% increase in completed hygiene appointments. After mandatory shutdowns began in March, performance quickly deteriorated.

Dental practices experienced the most significant economic impact of COVID-19 during the months of March, April, and May. Year-over-year completed hygiene appointment volume declined by 47% in April 2020 (figure 2).

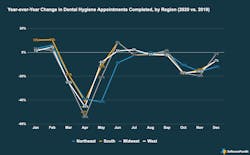

The study further analyzed hygiene appointment data to understand how differently the pandemic impacted different regions in the US. Overall, the pandemic appears to have had a similar impact on practices across the US.

Some minor differences by region (figure 3):

- In the Northeast, the initial decline in appointments extended into May and June, and the decline in the fall was not as severe.

- The Midwest experienced the greatest decline in appointments in both the spring and fall.

- The South had the most individual months of 5%+ year-over-year growth

Surprisingly, the top 10% of dental practices actually performed better economically in 2020 than in 2019. On average, the top 10% of practices performed better in terms of revenue, average patient value, and patient growth. One factor might be the top performers’ use of practice analytics software. Having clear visibility into dental practice key performance indicators (KPIs) allows practice managers to detect issues early and experiment with tactics to boost growth.

In contrast, the bottom 10% of practices saw a decrease in performance between 2019 and 2020. The bottom 10% experienced a decline in annual patient value of 15% in 2020 and a patient decline of 12%.

Combined, these signals suggest that the pandemic actually exacerbated the performance gap that exists in the dental market. While the long-term impact of the pandemic is unknown, this is certainly a troubling indicator for overall market health (figure 4).

Bruce Hogan is cofounder and CEO of SoftwarePundit, a technology research firm that provides advice, information, and tools to help dental practices successfully adopt technology. From highlighting industry-specific trends to delivering extensive software guides, SoftwarePundit helps dental practices select the best software for their needs.

About the Author

Bruce Hogan

Bruce Hogan is cofounder and CEO of SoftwarePundit, a technology research firm that provides advice, information, and tools to help dental practices successfully adopt technology. From highlighting industry-specific trends to delivering extensive software guides, SoftwarePundit helps dental practices select the best software for their needs.