Tackling the Debt Monster: Why smarter choices in college equal easier days after graduation

First decide if a traditional formal education is for you

Conventional wisdom states that in order to get ahead one must first obtain a college degree, with the guiding thought being “the bigger better.” I have previously made the argument that for several reasons there are actually other options besides a formal four-year education from a “premier” institution. Job prospects are a key consideration for people deciding whether or not to pursue this. However, considering the growth prospects of the dental hygiene profession, a smart bet for any of these practitioners would be to gain the advantage that a bachelor’s degree offers.

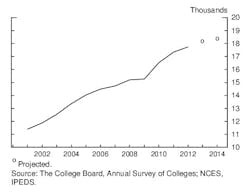

Tuition and other costs have been increasing and this trend is expected to continue.(1) According to the College Board, the average cost of tuition and fees for the 2013–2014 school year was $30,094 at private colleges, $8,893 for state residents at public colleges, and $22,203 for out-of-state residents attending public universities.(2)

For those who are determined to go this route, you may quickly find that the only way to achieve this goal is to borrow to finance it. There are other avenues to explore such as scholarships and grants, but those will apply to the great minority reading this and so we shall focus only on loans here.

Student Loan Debt: General overview

Outstanding student loan debt in the United States has risen nearly 70% over the past five years to Feb 2014. The vast majority of new originations have been federally backed (as opposed to private) loans. Student loans are used by over 90% of college students, and the average student in the United States graduates with $26,600 worth of debt.(3) One in 10 graduates accumulate more than $40,000 worth! Borrowers typically begin repaying their debt six months after graduation, and the standard repayment plan in the industry is 10 years.

Not So Fast – Dental students are special!

The previously mentioned figures are averages across a number of disciplines. According to the American Dental Education Association,(4) the average dental student pays $38,000 to $54,000 in tuition per year, 75% will carry more than $100,000 in debt, and the average dental student graduates with upwards of $241,000 of student loan debt! Sound like a good way to get started in life? Welcome to America in the second decade of the 21st Century.

I can just walk away, can’t I?

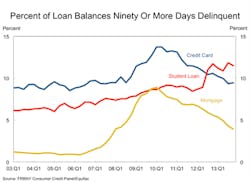

About 11.5% of student loan balances are more than 90 days delinquent or in default.(5) Defaulting on your student loan is not a good idea, as such debt is non-dischargeable. This means that it is still due and payable even if you were to declare bankruptcy. The government can garnish your wages, take your tax refund, social security and disability payments, and sue you.

Plus, the legal and collection fees associated with pursuing you get added to your principal balance. Collection fees alone could add a huge 25% to your outstanding loan amount.

The government's average gross recovery rate on defaulted Stafford loans is 109%.(6) That is, after adding in penalties and fees, the government eventually collects $1.09 for every $1.00 of defaulted Stafford loan debt. In terms of avoiding its repayment, you should think of student loan debt as similar to Federal taxes. It is payable when due, no exceptions.

In any event, the honorable approach to take is to be responsible. If you borrow money for any reason, you should be doing it with the honest intent (and more importantly, a plan) to pay it back. To do otherwise would be immoral.

Types of loans available: General Overview

As you venture and do your own research (which is vital, as everyone’s situation is different and only you can make the best assessment of your own!), you will see that there is much ground to cover. Although the largest lender is the U.S. government itself (via the U.S. Department of Education), there is also the private sector to consider, and you will often be dealing with intermediaries who will service your loan. You can find several resources in the “links” section of this article to help you get started.

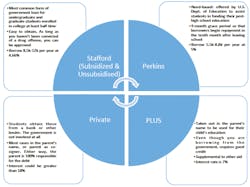

The U.S. has two federal student loan programs that form the core of all available financial aid:

· Direct Loan is a low-interest loan for students and parents to help pay for the cost of a student's education after high school. The lender is the U.S. Department of Education. There are basically four types of direct loans:

· Stafford Subsidized (no interest accrues while student is in school)

· Stafford Unsubsidized (interest accrues while student is in school)

· Direct Plus: Can help pay for education expenses not covered by other financial aid — a supplementary option

· Direct Consolidation: Allows you to combine multiple federal education loans into one. The result is a single monthly payment

· Perkins loan is a needs-based program where the intermediary is your school. Certain types of Perkins loans are forgivable depending on the type of profession.

The illustration below attempts to capture the important aspects of each student loan option, but it is by no means comprehensive – remember, you are only getting started here and there is much work to do to explore and absorb every potential option available to you:

Loan Forgiveness

Certain types of student loans are eligible for forgiveness programs, but they come with strings attached. Given their service to the nation, veterans in particular have many options at their disposal. Otherwise the idea behind government forgiveness is that it creates an incentive for students to enter certain professions (and in certain parts of the country) where there is a shortage of candidates for whatever reason. There are also many types of loan repayment programs offered at the state level that would be impractical to cover here in a comprehensive fashion. The American Dental Association is an excellent resource for loan repayment program details.(8)

The National Health Service Corps is another government agency (part of the Department of Health and Human Services) that provides loan repayment relief, in exchange for the student eventually applying for work in “underserved” communities.(9)

Finally, there is also something called the “Pay as You Earn" (PAYE) program.(10) The government forgives any qualifying student loan after the student pays a certain percentage of his income toward the loan for a certain number of years. Any forgiven amount is a loss to the government, and thus to taxpayers. The PAYE program does not apply to PLUS or private loans.

That was just to get you started

All of the preceding is intended to get you started only. You must first assess your particular situation (in what part of the country are you located, what school do you want to attend, where exactly would you like to work, etc.) and then do the research to find the option that best fits you. As you may have already come to realize, the possible combinations can get intricate and confusing. Like anything else, that at first seems complicated, breaking this process down into manageable parts and attacking them one at a time. This entails a lot of work and time, and you should undertake this before you enroll in any dental program. This process of getting your hands around and thoroughly understanding these options is very much a “ground zero” preparation for your formal education. Approach it as such – an unofficial “semester” on Financial Aid 101!

References

- https://trends.collegeboard.org/college-pricing

- https://trends.collegeboard.org/college-pricing

- http://www.projectonstudentdebt.org

- http://www.asdanet.org/debt.aspx

- http://www.newyorkfed.org/householdcredit/2013-Q4/HHDC_2013Q4.pdf

- http://febp.newamerica.net/background-analysis/federal-student-loan-default-rates

- https://studentaid.ed.gov/repay-loans/forgiveness-cancellation/charts#perkins-loan-cancellation

- http://www.ada.org/~/media/ADA/Education%20and%20Careers/Files/dental-student-loan-repayment-resource.ashx

- http://nhsc.hrsa.gov/loanrepayment/

- http://www.ibtimes.com/obama-announce-student-loan-debt-relief-expansion-pay-you-earn-1596207

Resources

- http://thecollegeinvestor.com/the-definitive-guide-to-student-loan-debt

- http://www.newyorkfed.org/householdcredit/2013-Q4/HHDC_2013Q4.pdf

- https://studentaid.ed.gov/types/loans

- http://www.caseyresearch.com/my/displayTcr.php?id=109

- http://www.forbes.com/sites/robertfarrington/2014/07/14/parents-stop-taking-out-loans-for-your-childs-college-education/

- https://trends.collegeboard.org/college-pricing

- http://www.direct.ed.gov/

- http://www.projectonstudentdebt.org

- http://febp.newamerica.net/background-analysis/federal-student-loan-default-rates

- http://www.consumerfinance.gov/askcfpb/1555/what-pay-you-earn-paye-how-do-i-know-if-i-qualify.html

- http://www.asdanet.org/debt.aspx

- http://www.raconline.org/funding/type/loan-repayment-programs

- http://www.ada.org/en/education-careers/dental-student-resources/financial-resources-for-students-and-recent-gradua

- http://nhsc.hrsa.gov/loanrepayment

- http://www.ibtimes.com/obama-announce-student-loan-debt-relief-expansion-pay-you-earn-1596207

Juan Acevedo is vice president of financing and accounting at The Chandler Corporation, an international investment group. He earned a bachelor’s in finance from St. John's University in 1992 and a MBA-International Economics from Pace University in 1999. Mr. Acevedo has more than 20 years’ experience as a practitioner in financial services, possessing global buy-side compliance, operations, and risk management experience in large and small organizations, notably at Morgan Stanley Investment Management. He currently resides in Singapore with his wife and two children.