7 simple steps to plan your way to profitability in 2012

By Kristin Pelletier

As you approach the end of the year, it’s a great time to reflect on how well you met your financial goals for 2011. If you reached your goals, congratulations! If you aren’t satisfied with your 2011 results, or you want to reach the next level of success, an annual practice profitability plan is a great place to start.

Without a well-thought-out plan, practices often flounder under the weight of unplanned expenses. Wouldn’t you prefer knowing now what’s going to happen next year, rather than having to make a midyear correction that could be both costly and time-consuming?

By following the seven simple steps listed below, you can plan for the unexpected and reach your goals in 2012.

1. Analyze your expenses.

While you probably view your profit and loss statement as a tax document, you can also use it as a management and planning tool. Your profit and loss statement can tell you how your practice has operated in the past and can help you project — or more importantly plan — for the future. Group items from your P&L into the following categories (the associated industry standard ranges for each expense category are also noted):

- Personnel (salary, benefits, continuing education, etc.) — 22% to 28%

- Doctor direct (benefits, CE, insurance, licenses, etc.) — 2% to 4%

- Lab — 8% to 12%

- Marketing — 1% to 3%

- Facility — 4% to 8%

- Dental supplies — 4% to 7%

- Minor (office supplies, accounting, magazine subscriptions, etc.) — 6% to 10%

How do your previous year’s expenses stack up against the industry ranges? In total, your operating expenses should be 45% to 65% of your bottom line, excluding doctor compensation. Doctor compensation should be a minimum of 30%.

2. Forecast next year’s expenses.

Go through each of the categories from item 1 and make projections for 2012. Make adjustments by asking yourself the following questions:

- Do you plan to give your staff raises?

- Are you planning any equipment purchases?

- Do you intend to add any new technology?

- Is your staff attending any continuing education events that you are paying for?

Through this analysis, you will identify a minimum collection goal for the next 12 months. This is what it takes just to keep the lights on and your team paid. Divide this number by 12 to establish your minimum monthly collection goal.

3. Determine 2012 workdays.

Your 2012 workdays are simply the number of available workdays for each provider, taking into account things like vacations, snow days, training days, and any other planned or potential unexpected days off.

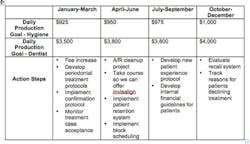

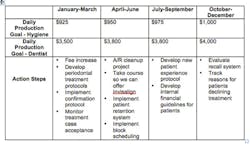

4. Establish your doctor and hygiene production goals.

Here are a few questions you’ll want to consider:

- Are you planning a fee increase?

- Are you planning to add new services?

- Are you going to set goals to improve systems in your practice that result in greater revenue?

Once you establish your new production goals for each provider, compare them to your last 12 months. Don’t make too big of a leap or you could find yourself making midyear corrections. You want to balance your potential against your history. Find the happy (and achievable) medium.

5. Determine your collection goal.

Can you improve your collections? Here’s a quick way to determine if you can improve your collections:

(e.g., insurance adjustments, patient discounts, bad debt write-off, etc.)

The resulting number should be a minimum of 98%. If it does come out to 98%, congratulations; your collections are solid. If it is less than 98%, then there is room for improvement. Improvements could include:

- Adding new systems to improve collections

- Working with a collection agency to improve your collections

- Hiring someone dedicated to collections

6. The bottom line.

Here’s where the rubber meets the road. Plug your numbers into the following formula: