Cash balance pension plans for dentists — maximize your current tax savings

There’s no question that current tax savings can have a positive impact for small business owners. This applies to many dentists because the most common type of dental practice is dentist-owned.(1) Looking beyond the normal 401(k) and profit sharing plans (PSP), cash balance pension plans are great tools for owners who have consistent excess cash flow. With a 401(k) PSP, owners are limited to annual contributions of $53,000 in 2015. For an owner with taxable income of $350,000 who’s in the 33% tax bracket, that’s $17,490 in current tax savings.

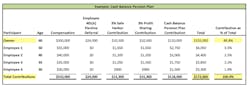

This is a nice benefit, but you can do much more with a cash balance pension plan that also creates current tax savings and asset protection. In addition to the 401(k) PSP, you could contribute in excess of $100,000 annually into the cash balance pension plan. A $100,000 contribution equals an additional $33,000 in current tax savings. Now that's a substantial impact! Over the course of five, 10, or 15 years, the impact can be monumental. Obviously there are some costs involved in plan administration and contributions for employees. However, these are small when looking at the big picture.

Although the cash balance pension plan takes some administration work by an actuary each year, the contributions are simply invested into a pooled investment account. During plan setup, investors choose a target rate of return, such as 3% or 5%, that will drive the contributions. All investment risk goes back to the owner, but most of the contributions are usually allocated to the owners anyway. For example, in years where the investments return less than the target the owner might be required to contribute more cash to the plan. In the same way, if the return in a given year is much higher than the target, the owner might be limited to a smaller contribution. It’s important to have consistent cash flow to manage the plan because you need to be committed to funding the plan for at least five years to be in compliance with plan rules.

Lastly, when retirement arrives or the owner sells the business, you’re able to close the cash balance pension plan and roll your plan balance into an IRA, or possibly annuitize just like you would do with a 401(k) PSP. For practicing dentists that operate as owners and generate annual excess cash flow, this plan is definitely worth considering. With the cash balance pension plan you can be sure you’re maximizing current tax savings while also maintaining asset protection.

References

1. Guay A, Warren, Matthew MA, Starkel R, Vujicic M. (2014). A proposed classification of dental group practices. Health Policy Institute American Dental Association, February 2014, Research Brief

2. Evans AL, Irving JH, (2015). Cash balance plans for professionals. Journal of Accountancy, March 2015, 48-53

Disclaimer

Waddell & Associates is an SEC-registered investment adviser. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.