Reading the Bars

by Dr. Donald R. Berger

Reading the bars is a method of acquiring market knowledge day-by-day as this information is important for the speculator to understand the direction of the market. Knowledge on the direction of the market is gained by using the true highs and true lows of each individual bar. Knowing what the present market is doing day by day allows you to identify new random behavior before traditional technical indicators signal a change or turn in the market.

Most traditional technical indicators are derivatives of the bar data.They are moving averages or averages that are sliced and diced a number of different ways. Most importantly, because these techinal indicators are averages, they tend to be late. This gives the trader an average location to start the trade off which does not afford the opportunity to take a small loss or scratch or to maximize the reward /risk when the trade is a win.

Reading the chart bar by bar

The four kinds of bars are:

- Buyer bar - buying behavior or demand behavior

- Seller bar - selling behavior or supply behavior

- Inside bar – shows no direction

- Outside bar – continuation of a trend or change

True highs are defined as the maximum of either the current bar’s high or the previous bar's close.

True lows are defined as the minimum of either the current bar's low or the previous bar's close.

Buyer Bar

Buying behavior or Demand Behavior

Current Bar has a True High > True High 1 ago

Current bar has a True Low > True Low 1 ago

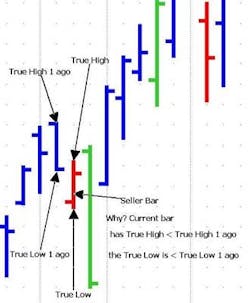

Seller Bar

Current Bar has a True High < True High 1 ago

Current Bar has a True Low < True Low 1 ago

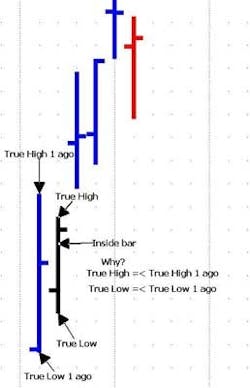

Inside Bar

Inside Bar - gives no new directional information about the market , because there are no new true highs and true lows. The inside bar is viewed as nuetral.

Inside Bar – True high =< True High 1 ago

True Low =< True Low 1 ago

Outside Bar

Outside Bar – an alert for a change in trend or a continuation of the present trend . The change or continuation is confirmed by the bar that follows the outside bar. The bar can be green or yellow in color.

As a self-directed Investor, it is important to understand how to read the bars so that one can utilize this knowledge to better understand the direction of the market. With time and devotion to learning and understanding the markets, anyone can become a self-directed Investor.

For more information, Dr. Donald R. Berger can be reached by e-mail at [email protected] or by phone at (215) 896-7448. Visit his Web site at www.dberger.org.