Tele-orthodontics and the future of dental digitalization

People have become aware of tele-orthodontics during recent years, especially because of the litigation between SmileDirectClub, Align Technology, and the American Dental Association. However, tele-orthodontics’ real-world practice, current trends, and potential future have not yet been systematically discussed. By examining the core technology and industry landscape of tele-orthodontics, here I will outline the future trends of dental innovation.

Generally, the history of teledentistry can be divided into four stages. The first application of teledentistry was by the US Army in 1994 and was used for overcoming communication difficulties.1 At the beginning of the 21st century, teledentistry was used in hospitals and clinics on a limited scale.2 In the following years, teledentistry was mainly used to improve the health-care situations in remote and poor areas of Australia,3 France,4 and other countries.5 The specific practice of tele-orthodontics began with SmileDirectClub and a series of similar companies in 2014. By connecting authorized dentists with patients, these innovative companies first took teledentistry to mature business practice.

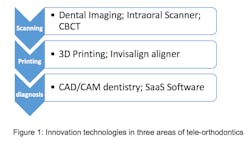

To provide convenience and save patients time, tele-orthodontics is making strides in three areas of orthodontics—oral scanning, aligner printing, and clinical diagnosis. For example, companies such as Uniform Teeth and Orthly are devoting themselves to designing mobile apps for matching dentists and patients. Also, 3-D printing technology is used by companies such as Stratasys and Shining 3D for faster printing. Many related cases can be found in Figure 1.

Leading players in the world use tele-orthodontics in some parts of their solutions, but onsite work is still needed for other parts. Compared to diagnosis and printing, scanning solutions are especially difficult to realize in totally remote situations (figure 2).

Tele-orthodontics requires a high degree of coordination between scanning, printing, and diagnosis. Most dental device companies today do not aim to cover all of the sub-sectors of dentistry, and many of them cooperate with other companies in specific parts of their orthodontic solutions. Aligners may be the only product independently developed by nearly all of orthodontic solutions providers, while products in other segments may be compatible (table 1). This is because aligners are often required to overcome new and key challenges.

As a technology barrier, aligners are a key issue for tele-orthodontics. Traditional orthodontic players such as Straumann, ClearCorrect, Align, and Specialty Appliances all use thermoformed polycarbonate as the main material in their aligner products. For tele-orthodontics, the aligners must also offer water absorption,6 transparency, and more. For this reason, SmileDirectClub uses vinyl polysiloxane (VPS) in its impression kit to avoid the influence of temperature changes during transportation. Also, 3M uses thermoplastic silicone resin with VPS in Clarity, one of their orthodontic products. Smilie in China has used propylene and polyvinyl acetate in its aligner materials. In addition, Henry Schein, SmileDirectClub, and Candid Co emphasize that BPA and phthalates are removed from plastic materials in their aligners or retainers.

Another key issue for tele-orthodontics is regulation.7 Most recently, tele-dentistry has been facing criticism from the ADA as a result of tele-orthodontics’ competition with dental clinics and hospitals. Meanwhile, some academic research continues to approve telemedicine8 and appeal for more rational opinions.9 If this argument continues and none of the tele-orthodontics players receive policy advantage first, an undesirable price war may arise. The experiences of e-hospital and transportation network sectors has proven this.

Furthermore, the cyclicity of digital health should be mentioned. According to Healthcare Growth Partners, the revenue multiplier used for the valuations of health-care IT companies decreased from four in 2016 to 3.6 in 2017. This means enterprises with the same revenue capacity are receiving lower valuation from the market. In addition, the average valuation of health-care SaaS companies is lower than general SaaS companies with the same growth rate.10 The industry cyclicity is negative for the development of digital dentistry.

Tele-orthodontics is experiencing rapid growth and fierce competition. However, the market’s passion of digital health care is gradually cooling down. Providers of tele-orthodontics solutions should overcome their problems as soon as possible in case they see further problems such as technological challenges and capital chain ruptures.

Jianan Huang is a research scientist at Zhejiang University Faculty of Medicine. Contact Huang for more information at [email protected].

References

1. Kravitz ND, Burris B, Butler D, Dabney CW. Teledentistry, Do-It-Yourself Orthodontics, and Remote Treatment Monitoring. Journal of Clinical Orthodontics 2016:50(12);718-726.

2. Bauer JC, Brown, WT. The Digital Transformation of Oral Health Care: Teledentistry and Electronic Commerce. Journal of the American Dental Association 2001:132(2);204-209.

3. Sabesan S, Kelly J, Evans R, Larkins S. A Tele-Oncology Model Replacing Face-To-Face Specialist Cancer Care: Perspectives of Patients in North Queensland. Journal of Telemedicine and Telecare, 2014:20(4);207-211.

4. Petcu R, Ologeanutaddei R, Bourdon I, Kimble C, Giraudeau N. Acceptance and Organizational Aspects of Oral Tele-Consultation: a French Study. Hawaii International Conference on System Sciences. 2016.

5. Kumar S, ed., Teledentistry, Cham: Springer International Publishing. 2015.

6. Dupaix RB, Boyce MC. Finite Strain Behavior of Poly (Ethylene Terephthalate) (PET) and Poly (Ethylene Terephthalate)-Glycol (PETG). Polymer, 2005:46 (13);4827-4838.

7. Sfikas PM. Teledentistry: Legal and Regulatory Issues Explored. Journal of the American Dental Association, 1997:128(12);1716-1718.

8. Liles JS, Askew CS, Arguello CR, et. al. Tele-Medicine is Safe and Conserves Resources in the Preoperative Management of Pheochromocytomas. Annals of Surgical Oncology 2009:16:64-64.

9. Ambrosino N, Makhabah DN. Tele-Medicine: A New Promised Land, Just to Save Resources? European Respiratory Journal 2017:49(5);1700410.

10. Enterprise SaaS vs. Health IT SaaS Valuation Analysis. http://hgp.com/research-and-news/2017/05/05/enterprise-saas-vs.-health-it-saas-valuation-analysis/. Accessed February 28, 2019.

About the Author

Jianan Huang

Jianan Huang is a research scientist at Zhejiang University Faculty of Medicine. Contact Huang for more information at [email protected].