Disruption is on the horizon, and it will be great for dentists and their 401(k)s

If you're over the age of 40, you probably remember visiting a crowded Blockbuster and frantically looking for a popular movie before all of the copies were rented for the weekend. I'm sure I speak for all of us when I say that nobody who meandered regularly through Blockbuster had a clue what was coming-that one day the video store model would be antiquated and we'd never again have to search for a physical copy of a movie.

This is how disruption works. It comes on slowly like a light snowfall, and might seem irrelevant at first, but in a very short period of time it unleashes a blizzard of change that leaves only the innovators standing. Blockbuster never saw it coming. In 2008, then-CEO Jim Keyes said, "Neither RedBox nor Netflix are even on the radar screen in terms of competition." He later declined to buy Netflix for a mere $50 million. Oops!

There are certainly disruptive technologies and services that will impact dentistry, and most of them will be great for dentists and patients. But those who are committed to sticking with the old-school approaches may find themselves crying in their beer next to Jim Keyes.

Beyond the technological advancements, there are other disruptions to service providers in the dentistry space. This article will focus on one that impacts nearly every dentist, and employee of a dentist, in the nation—the 401(k) plan.

For most dentists or staff, the 401(k) is something to "set and forget." The old guard providers (think Blockbuster), mainly insurance companies and payroll companies, like it this way. Why? Because for decades the 401(k) has been a feeding trough for brokers, mutual fund companies, record keepers, and a host of other unnecessary middlemen. The net result is often hidden and excessive fees that erode the accounts of dentists and staff who are saving their hard-earned money.

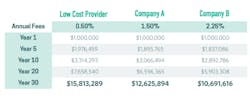

Just how much do fees impact the growth of a typical 401(k) plan? Take a dentist with $1 million in his or her plan with total contributions of $100,000 per year. Let's assume an annual performance of 7% over time. Here is a comparison between a low-cost provider and typical plans with fees of 1.5% to 2.25% annually.

As you can see, all things being equal, this plan will have dramatically different results depending on the choice of providers. Reducing fees is quite easy, but first you must uncover how much you're really paying. Your fees will be buried deep in lengthy and often opaque fee disclosures that you should request from the customer service department of your provider. (Click here for a list of phone numbers for each provider to make a call now.)

Why are most of the existing plans so darned expensive?

1. Brokers win—The industry often puts its own compensation first. Brokers-the boots on the ground who sell the plans-get hefty fees extracted every year. They might be great people, but make no mistake, they get paid first.

2. The funds in the plan—The funds in most plans are there by design because brokers are willing to share in their revenue with the provider. This "pay to play" scenario means you often find expensive funds in your plan, not low-cost index funds that have been shown to outperform expensive "actively managed" funds found in most plans.

3. Small plans pay more—Today's providers charge small and midsize businesses substantially more than mega plans with Fortune 500 companies. They are often told they don't qualify for lower-cost funds or plans without paying substantial commissions

401(k)s still have a vital role

Some people would say that the 401(k) is broken. That's simply not true. Don't mistake the suitcase for the contents. The 401(k) is a just receptacle and what goes inside (low-cost funds vs. expensive, actively-managed funds) and how fees are extracted will ultimately distinguish between a 401(k) that's running smoothly and one that is trudging through mud.

Now for the good news. There are a handful of providers on the forefront of a "Netflix moment" in 401(k) plans. This is one where brokers are eliminated, the funds are low-cost and there's no "pay to play," local administrators are deemed obsolete thanks to technology, and instead of educational sessions that offer stale donuts during break, participants have personalized advice and on-demand educational videos delivered to them 24/7.

How do you learn if you're paying excessive or hidden fees? Uncovering your true fees can be daunting due to the many layers of fees and money changing hands. Our firm will do this financial archeology at no charge and give you a benchmark for your files. (Note that a periodic benchmark is required by law.) If you can shave one annual percentage point off of your fees, your money could last 10 years longer in retirement. Just like small returns compound over time, high fees do the same thing with the reverse effect.

Only 3% of dentists could retire at age 65 without making changes to downsize their lifestyle. It doesn't have to be this way. Sure, one needs to save as much as possible, but if there is a "hole in your boat," it will not matter how disciplined you are.