How to maximize value and minimize taxes when selling a dental practice

Selling a dental practice has many moving parts, not the least of which is handling taxes. No selling dentists want to be caught paying too much in taxes when they sell their practices. Here are some helpful tips.

This article originally appeared in the Principles of Practice Management e-newsletter. Subscribe to this informative twice monthly practice management ENL here.

Have you ever thought about SELLING YOUR DENTAL PRACTICE? Sure, it will take some time and careful planning, but it’s not as complicated as you might think to maximize the value of your practice. One of the most important considerations every dentist should think about before signing on the dotted line is: what are the tax consequences of selling? No one wants to be surprised by post-sale financial responsibilities, especially taxes. It’s also important to get the most money for the practice, which is likely a dentist’s most valuable asset. Here are several strategies and money-saving insights to help make selling a dental practice a much less taxing process.

Tax fundamentals

How the practice was originally established plays a significant role in determining the tax liability related to the sale of your practice. For example, if your practice was set up as a regular C Corporation (C Corporation profits are taxed separately from the owner), all income from the sale is taxed at the corporate level. The federal corporate tax rate is currently 34%, or 35% with income greater than $335,000. If your practice was set up as a regular partnership (often a limited liability company or limited liability partnership), S Corporation, or sole proprietorship, the sale has both ordinary and capital gains income taxes that are paid by the owners on their personal income tax returns.

Maximize practice value

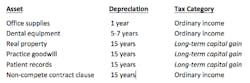

Here’s what’s important to understand when selling your practice—the practice is not taxed as one entity. A dental practice contains several different kinds of assets—equipment, supplies, real property, goodwill—and each asset requires separate accounting and tax rules. Why? Because the IRS has established different depreciation and time factors for each practice asset. Here’s a breakdown of practice asset depreciation and tax accounting:

Maximizing the value of your practice requires strategically placing the majority of practice sale income in assets taxed as long-term capital gains. In most sales, the value of the practice is largely comprised of the goodwill of the practice, which can help reduce the amount of taxes owed after the sale of the practice.

How to minimize taxes when selling your practice

An example of how allocation of practice income can save taxes

1. Real property improvements (book value) $267,308, sold @ $250,000 = ($17,308) (ordinary loss)

2. Equipment (book value) $20,801, sold @ $75,000 = $54,919 (ordinary income)

3. Goodwill sold @ $650,000 = $650,000 (capital gain)

4. Assuming 20% capital gains rate and 35% ordinary income tax rate = $143,163 tax payment

Consider the following adjustments to practice income

1. Real property improvements sold @ $150,000 = ($117,308) (ordinary loss)

2. Equipment sold @ $5,000 = ($15,801) (ordinary loss)

3. Goodwill sold @ $845,000 = $845,000 (capital gain)

4. Assuming 20% capital gains rate and 35% ordinary income tax rate = $122,412 tax payment

By properly reallocating practice income valuation, there’s a $20,751 tax savings.

Final considerations

After selling your practice, your personal tax liability depends on your current tax situation (including filing status, additional income sources, deductions, and claimed dependents), plus consideration of both ordinary and capital gains income from the sale. Most dentists report income from the sale of their practice during the same year. That said, some practice sale income might be deferred based on the date of sales agreement and timing of payout. It’s always best to consult a tax professional and attorney with experience in practice sales to help answer any questions based upon your personal finances and practice deal structure to determine all tax implications.

For the most current practice management headlines, click here.

For the most current dental headlines, click here.

Michael S. Cerow, CPA, is principal owner of Cerow and Company CPAs, PA, in Melbourne, Florida, and Don Spiert is Director of Acquisitions at Benevis Practice Services, an Atlanta-based DSO. Mr. Cerow can be reached at (321) 242-2511 and [email protected], and Mr. Spiert can be reached at (844) 879-0087 and [email protected].